Medicare Part D (Prescription Drugs)

Medicare Part D, sometimes referred to as a PDP (prescription drug plan), provides prescription drug coverage. Original Medicare alone does not provide prescription drug coverage. You’ll have to find prescription drug coverage in one of two different ways: either enroll in a PDP on top of your Original Medicare (Parts A and B), or purchase a Medicare Advantage plan.

If you do not enroll in some form of prescription drug coverage when you are eligible, you will be held liable for a late enrollment penalty fee.

Part D Coverage

Part D coverage is not the same for every plan. Each plan will have a formulary, which is a list of all the prescription drugs that it covers. The formulary will be divided into tiers according to cost level. Generally, tier one comprises of preferred (cheapest) generic drugs, and costs increase as you get to tier five, which usually includes speciality brand-name drugs.

Part D Costs

If you choose to invest in a Medicare Advantage plan, your prescription drug premium will be included in your medical premium. If you choose to keep your Original Medicare and enroll in a separate prescription drug plan, you will have to pay a separate premium. Unless you are eligible for LIS (low-income subsidies), you will be responsible for anything from $13 to $80 per month depending on your income.

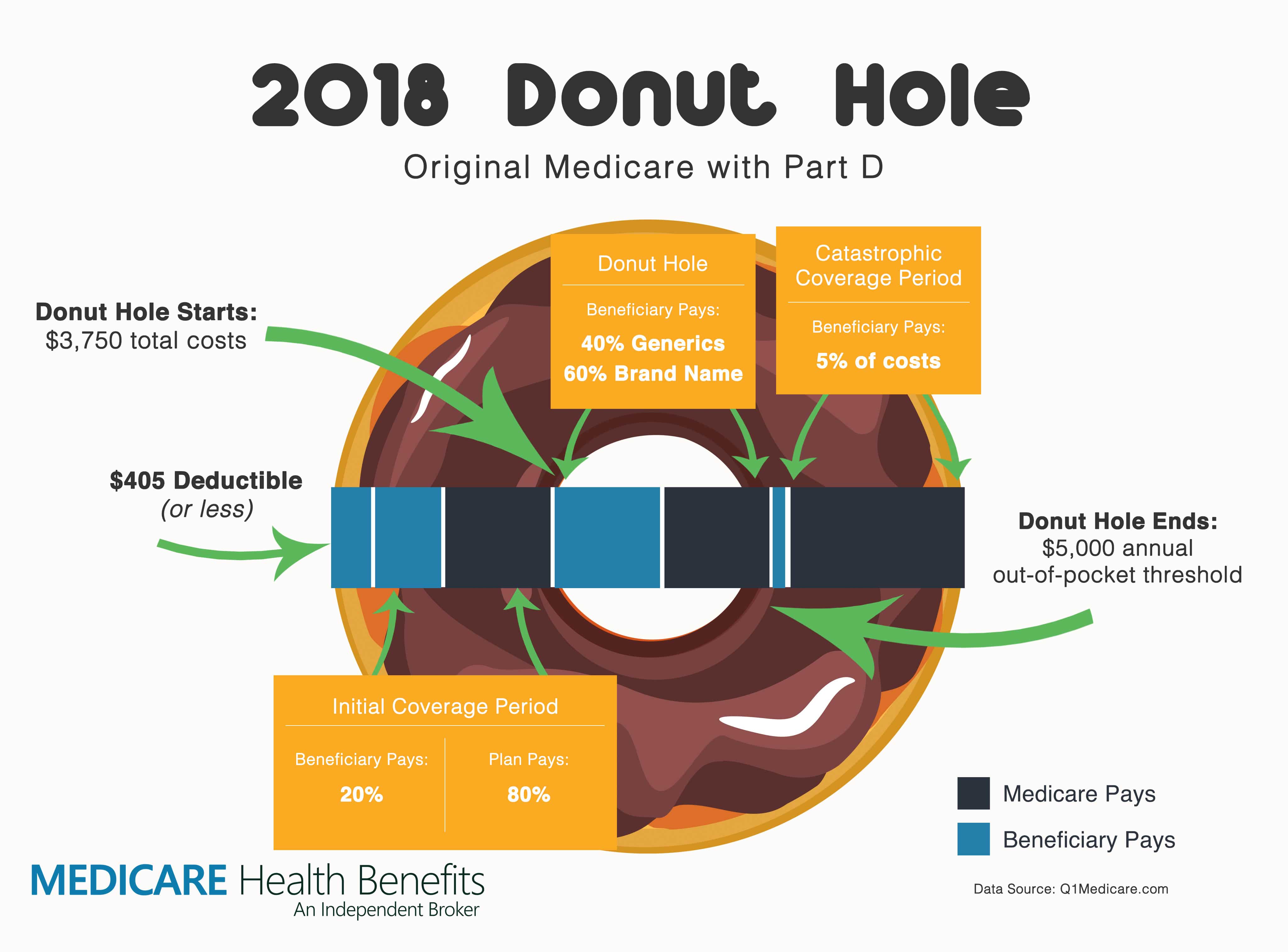

The Donut Hole

Unless you have Extra Help (a savings program for those in need), you will fall into a prescription drug coverage gap known as The Donut Hole.

The Donut Hole means that once you spend $3,750 (2018), you will be responsible for 60% of your brand-name drug costs and 49% of your generic drug costs. This is much higher in comparison to the 20% that you are normally responsible for before you spend that $3,750. It’s called a coverage “gap” or a donut “hole” because once you hit your out-of-pocket maximum ($5,000 in 2018), you’ll be out of the gap and Medicare will cover your prescription drugs in full. Let’s clear that up:

- In the beginning of the year, you will be responsible for all of your prescription costs until you reach your deductible (2018 standard is $405).

- Once you’ve paid your deductible, you will only need to pay 20% of your drug costs - until you spend $3,750 (2018).

- Once you’ve spent that $3,750, you will be responsible for 60% of your brand-name drug costs and 40% of your generic costs - until you spend $5,000.

- Once you’ve spent $5,000, you should not incur any more out-of-pocket costs.

Part D Enrollment

Just like Original Medicare, if you do not enroll in a Medicare prescription drug plan when you are eligible (disabled or 65), you will be responsible for a late enrollment penalty fee. If you need help enrolling, applying for low-income subsidies, or sorting through your options, you can set up a free appointment with one of our agents. Our agents are licensed to sell from several different carriers, so there will be no bias in their assistance. Call to schedule your appointment at 1-833-255-0113.

Request an Appointment with a Local Agent.